SME Financing Guarantee Scheme

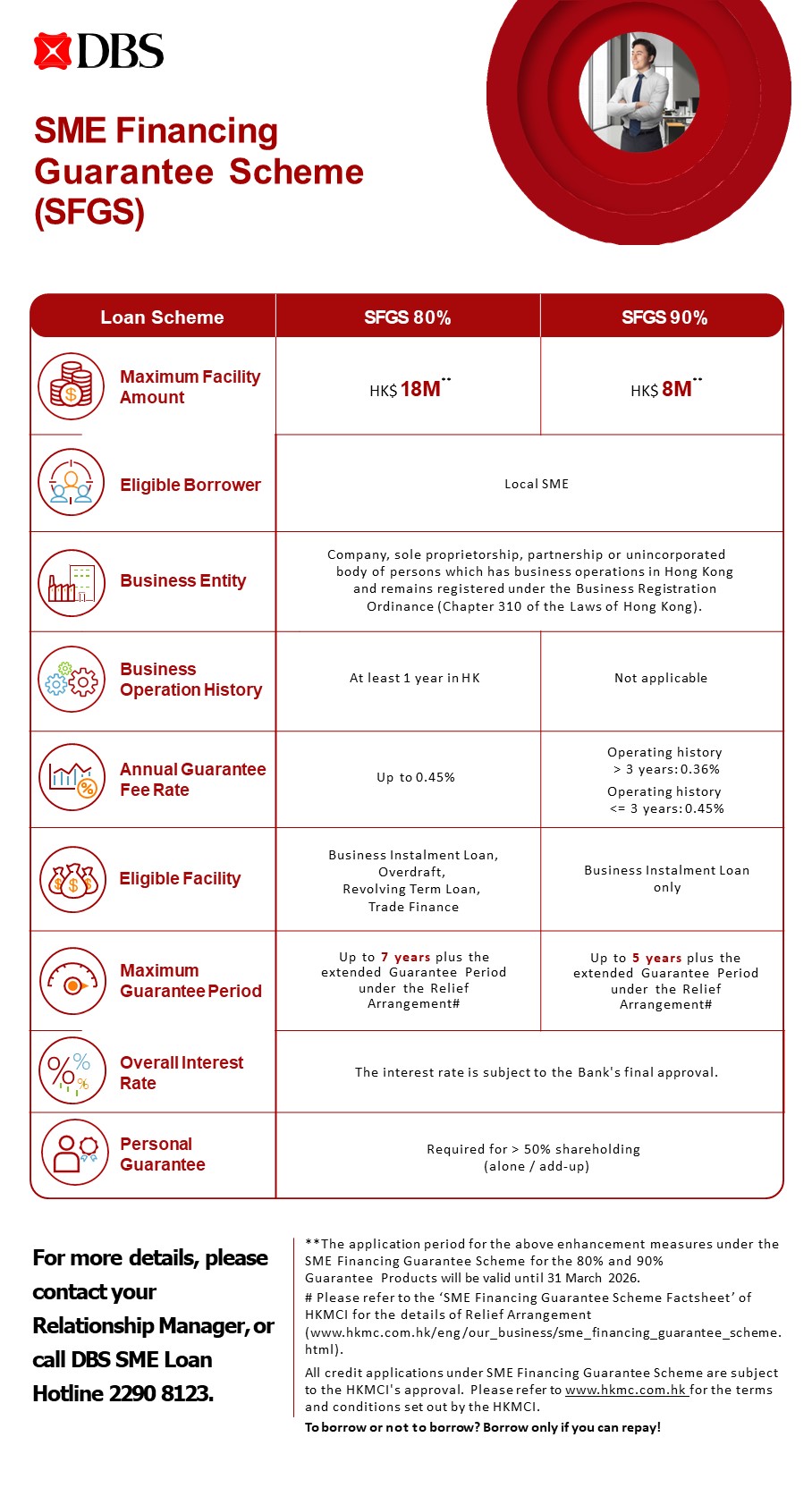

Launched by HKMC Insurance Limited (“HKMCI”), the scheme aims at helping local SMEs and non-listed enterprises to obtain financing for meeting business needs.

Launched by HKMC Insurance Limited (“HKMCI”), the scheme aims at helping local SMEs and non-listed enterprises to obtain financing for meeting business needs.

From now until 31 March 2025, successful SFGS applicants of 80% and 90% Guarantee will be eligible for the following DBS offers#:

Notes on applying for the SME Financing Guarantee Scheme

• All credit applications under SME Financing Guarantee Scheme are subject to the HKMCI's approval. Please refer to www.hkmc.com.hk for the terms and conditions set out by the HKMCI.

• The Borrower must not have any outstanding default as defined by the Scheme.

• Shall not be carrying on the business of a lender or otherwise providing funds available for borrowing in any way.

• For more information on SME Financing Guarantee Scheme, please refer to HKMCI website.

----------------------------------------------------------------------------------------------------------

# This Promotion Offer applicable to 80% and 90% Loan Guarantee under SME Financing Scheme only and is subject to the relevant Terms and Conditions. Please refer to the Terms and Conditions for details.

| What is the interest rate? | |

| SMEs enjoy competitive interest rates that are determined based on their business profile and financial records |

| What can I do if my loan application is not accepted? Is there a process to review the decision? | |

| If you have any questions or need to discuss the result of your loan application, please contact our "SME Credit Approval Review Hotline" at 2290 8050 or email to [email protected] |

To borrow or not to borrow? Borrow only if you can repay!

How would you rate your overall experience on this site?

What areas need improvement?

How can we make your browsing experience better?

Thank you! We've heard you.

Your feedback is valuable to us.

That's great to hear. Anything you'd like to add?

We're sorry to hear that. How can we do better?